These statements are made by City Commissioner Evan Bonsall on his own behalf. They reflect his own personal beliefs, and are NOT official statements made on behalf of the City of Marquette or any other members of the Marquette City Commission. This website is Evan Bonsall’s personal website – it is NOT the City of Marquette website or a news organization.

UPDATE: The City Commission approved a 2.6379 mill operating millage increase at the June 21, 2022 special meeting, raising the City’s of Marquette’s operating millage rate from 14.9225 mills to 17.5604 mills. The vote was 7-0 in favor of the increase. You can watch the official meeting video by clicking HERE.

For over a year now, the City has been dealing with significant budgetary challenges – after millions of dollars in cuts and cancelled or delayed projects, we are still facing a roughly $2 million structural deficit (out of an annual General Fund budget of around $20 million), and the only remaining alternatives are deep, long-term cuts to City services or raising new tax revenue. Tomorrow, Tuesday, June 21, at 5:15pm at City Hall, the City Commission will be holding a special meeting at which we will discuss and likely vote on an increase in the City’s property tax rate (a.k.a., our operating millage), potentially raising the City’s property tax rate from 14.9225 mills to 17.5604 mills (an increase of 2.64 mills, or 17.7%). This would equate to a property tax increase of about $226 per year or $18 per month for the average homeowner in the City of Marquette, with a similar effect on the average renter if landlords passed down 100% of the cost of the proposed increase to their tenants.

Here I have included answers to some of the most common questions that I have been asked by Marquette residents over the past few months. You can attend the meeting on Tuesday, June 21 or watch it live on Charter Channel 191 or the City of Marquette YouTube channel. Please don’t hesitate to reach out to me as well at (906) 236-0247, [email protected], or on Facebook – I am happy to answer your questions and I want to hear your perspectives and ideas! Finally, I encourage everyone to check out the City’s FAQ page on the proposed operating millage increase, and watch the presentation from the May 9 City Commission meeting – they are both very informative and eye-opening. You can view them by clicking HERE.

Q: Why is a tax increase necessary? Can’t the City just make some cuts here and there?

A: I completely understand why folks are concerned, and I certainly don’t want property taxes to go up, either – although I am a renter, a large portion of my rent goes to pay my landlord’s taxes, and increases in non-City property taxes were partially responsible for an increase in my rent this year. I and everyone else at the City have been working very hard on this issue for the past year. Last fall, the City was looking at a $4.5-6.0 million deficit going into FY2022. We made a lot of cuts (including virtually eliminating overtime and delaying numerous capital expenditures on things like vehicles, roads, etc.) and negotiated very minimalistic new contracts with most of our employees (raises in City contracts over the past 2 years have generally ranged from 0-3%) – that got us down to a $1.9 million structural deficit. A structural deficit is a deficit that exists not because of extravagant new spending, but because the City does not have enough revenue to maintain current basic services.

Further cuts to eliminate this deficit would have required drastic reductions in those basic services – furloughing or laying off numerous employees in every department (a loss of human resources that it would take many years to recover from), major reductions in snow plowing and routine road and park maintenance, potential closure or major hours reductions for key parks and community centers like Lakeview Arena, the Senior Center, and Peter White Public Library, delaying urgently needed capital projects (like the purchase of a new fire truck), and so on. As a result, for FY2022 (the current fiscal year) the City Commission covered the remaining deficit with $1.9 million from reserves (we still have about $8 million in reserves, down from $14 million in 2018). This was not intended to be a permanent fix – those reserves won’t last forever – but merely to the buy the City Commission and City staff enough time to look at every possible solution to the City’s budgetary problems and leave no stone unturned. We knew that tough decisions would probably have to be made this year.

At the end of the day, the closure of the Presque Isle Power Plant cost the City $1.5 million in annual tax revenue starting in FY2020, Tax Tribunal/dark store appeals have cost us hundreds of thousands of dollars more, state revenue sharing has declined significantly, and Proposal A has seriously limited the taxable values of properties (even as true cash values have increased dramatically). Without new revenue, the City will either have to enact deep cuts to City services (which I don’t think most City residents would be willing to tolerate), or we will spend down all of our remaining reserves by FY2025. This last option is terrible policy & would just be delaying the inevitable hard choices.

The City will likely still have to enact additional budget cuts this year, but there is very little “fat” left to trim after over a year of working very hard to minimize General Fund spending. If we’re going to maintain the City services and infrastructure that we already have, we will need to find a combination of spending cuts and new revenue this year.

Q: But didn’t the City just raise property taxes recently? My taxes keep going up every year!

A: No, the City has not raised our property tax rate since 2006. In fact, the City actually cut taxes in 2009 during the Recession, and never raised them again. In the meantime (especially in the past year), inflation and rapidly increasing material and fuel costs have hit the City hard, just like every business, family, and government entity in the country. Consider that in 2006 (the last time the City raised property taxes), a dollar had the same buying power as $1.44 today. That means a dollar only has about 70% of the buying power it did the last time the City raised its property tax rate, so adjusting for inflation, the City has about 30% less tax revenue per dollar of taxable property value today than it did in 2006! And that’s not even accounting for the fact that state revenue sharing is a lot lower today than it was in 2006, and that Proposal A has severely limited the growth of the taxable value of most properties in the City even as the true cash value of most properties has skyrocketed in that time. This is because the taxable value of a property can only change in Michigan according to an extremely conservative formula that always fails to keep pace with inflation, or when that property is sold, transferred, or substantially improved in some way. If your taxes have gone up substantially in recent years, this is because 1) your property was sold or transferred, 2) you made major improvements to your property, 3) it was previously undervalued and was re-assessed by the City Assessor, or 4) other local taxing entities (Marquette County, Marquette Area Public Schools, Peter White Public Library, the Iron Ore Heritage Trail, etc.) approved millage increases of their own – it is NOT because the City raised its millage rate.

Q: Why don’t you just cut Arts & Culture, Parks & Recreation, and tourism subsidies and promotions? Those aren’t essential services and they must cost a lot of money!

A: I’ve heard a few people suggest this, but it just doesn’t make much sense when you actually look at the City budget. Putting aside the fact that every City department has already had to make sacrifices this year, and ignoring the fact that the City’s Arts & Culture and Community Services (i.e., parks & rec) departments add tremendous value to Marquette and help make it a place people want to live (which I think is undeniably true and certainly not a secondary consideration when we’re talking about budget priorities), from a purely dollars-and-cents standpoint, Arts & Culture, parks, and tourism promotion are simply not the places you would look to fill a $1.9 million budget deficit.

Arts & Culture accounts for less than 1% of the City budget ($231,000 in FY2022), and in recent years they have not only been one of the most active and cost-efficient City departments, but they have actually generated almost as much revenue for the City as they cost the City through grants, fees, and events ($115,000 in FY2021 and a projected $164,000 in FY2022). Similarly, Community Services (i.e., parks & rec) accounts for only 3-4% of the City budget (~$500,000). In fact, many of the City’s parks and recreation services generate revenue and some even pay for themselves – for instance, we receive hundreds of thousands of dollars in revenue from Tourist Park each year, which has actually made a net profit for the City in recent years. Regardless, the City is not a business, it is a service provider – our parks system doesn’t pay for itself because it’s not designed to, and it frankly shouldn’t be. Parks exist for everyone in Marquette, and they cost money and require skilled, hard-working staff to maintain. Deep cuts to these two departments would be a tremendous loss for the Marquette community which would be felt by every resident, and even the complete elimination of these departments would only fill a small fraction of the City’s $1.9 million budget deficit, especially when accounting for hundreds of thousands of dollars in lost revenue.

As for tourism, the City does not spend any significant amount of money on “tourism subsidies or promotions.” We cut funding for “Community Promotion” from $45,000 to $4,500 in this year’s budget, and this money generally isn’t spent on promoting tourism. The City spends about $80,000 per year on special events, but these events are enjoyed by thousands of locals as well as tourists, and in reality they almost pay for themselves by generating about $60,000 in revenue for the City. Similarly, the DDA spends $30-60,000 per year on “Promotion & Marketing,” but brings in more than $30,000 per year in promotional revenue. In comparison to a $1.9 million deficit and a $20+ million budget, this is relatively insignificant.

Q: But what about all these big projects the City’s doing right now? It seems like the City is spending beyond its means on extras, and now they’re raising our taxes!

A: I completely understand how someone might get this impression, because the City has been able to do some really cool, highly impactful projects in the past few years. However, this isn’t because we are irresponsibly spending beyond our means or because we’re rolling in money – rather, this is a testament to the expertise, creativity, and extremely hard work of our City staff and other community members and organizations that have made these projects possible. To cite some of the big ones:

- Lakeshore Blvd. Relocation & Shoreline Restoration Project ($8-10 million project to move Lakeshore Blvd. 300 feet inland and prevent erosion and coastal flooding, paid for mostly through grants and Capital Improvement Bonds, with a small fraction of the road relocation funded through General Fund expenditures a couple years ago – also important to consider that the City was spending ~$300,000/year in General Fund money fixing up Lakeshore Blvd. and minimizing erosion after major storms devastated the shoreline almost every year).

- Kids Cove Playground (~$1 million playground at Lower Harbor Park funded entirely through grants and charitable contributions raised by Marquette Playgrounds for All – no cost to City taxpayers).

- Hurley Field Playground (refurbished playground at Hurley Field built using charitable contributions, volunteer labor, and a grant from the Marquette Public Art Commission – negligible cost to City taxpayers).

- Founders Landing Pier Project (two new public piers built south of the Lower Harbor Ore Dock at Founders Landing, a $5.6 million project funded entirely through Brownfield TIF revenue from the Founders Landing development, without a single taxpayer dollar from the rest of the City – this was part of the Founders Landing Brownfield Plan since its inception in 2009).

- Williams Park Repairs (funded almost entirely through grants and $40,000 in matching funds provided by the Marquette Tennis Assn. – the City only provided $8,000 in matching funds).

We have accomplished all of this in spite of our budgetary challenges, not because those challenges aren’t real or because were spending extravagantly. Foregoing these projects would have done virtually nothing to minimize the City’s current budget deficit, and would have cost Marquette some fantastic opportunities to improve our community. Even within very tight budgetary constraints, we can still do great things in Marquette if we’re creative and willing to put in the work.

Q: If the City needs new revenue, why can’t you just implement a ________ tax instead?

A: I have heard many reasonable and creative arguments from City residents that instead of raising property taxes, the City should implement some other tax. But after exhaustive research (believe me, I and many other folks at the City have lost a lot of sleep over this), there is simply no realistic alternative to a property tax increase, at least not for the near future. We have considered alternatives to a property tax increase, but these are very limited. For instance, a small City income tax (say, 1%) might make more sense in the long run than a millage increase, but it would not be possible to implement until at least 2-3 years from now, by which point our reserves will be completely exhausted without new revenue.

Lodging/hotel taxes would be a great source of revenue, but with very few exceptions they are essentially illegal under Michigan state law – and yes, that includes taxes on Airbnbs and other short-term rentals. The same is true of local sales taxes, which is another idea I’ve had a few people propose to me – they are simply prohibited by Michigan law. A voted bond levy could help with one-time capital expenses, but wouldn’t solve the core structural budget deficit issue the City is facing. DDA parking revenue goes directly towards paying for the maintenance of downtown parking, sidewalks, etc. – similarly, utility bill revenue goes directly towards paying for City water and sewer pipes and stormwater infrastructure. As a result, these funds cannot just be raided to cover the City’s budget deficit. This is what happens when the state government cuts revenue sharing, passes on unfunded mandates, and ties local governments’ hands to keep corporate lobbyists and partisan ideologues happy.

Q: What about making money from tourism? Can’t the City just raise fees for events or for non-City residents using our parks, or tax hotels and motels?

A: As mentioned above, Michigan state law prohibits the City of Marquette from charging sales or use taxes of any kind – this means that we cannot tax hotels, motels, campgrounds, Airbnbs, etc., like local governments can in most other states. We do already charge non-City residents higher user fees than City residents for many of our parks & recreation facilities, but according to Michigan state law, the City cannot just set user fees, permit fees, etc. as high as we want. In Michigan, local government fees may only be high enough to cover the cost of providing a particular service, and may not be any higher. As a result, raising fees is not a solution to the City’s budgetary problems. The City also cannot profit directly from tourism – whether a hotel is 100% full every night of the summer, or mostly empty most of the time, they pay the same amount of property tax to the City, and that’s it.

Q: What about marijuana? The City must be making a ton of money from all these new marijuana businesses moving into Marquette!

A: Aside from the relatively small amount of property taxes that marijuana businesses pay just like any commercial business, the City only gets revenue from marijuana sales through state revenue sharing – in FY2021, we received $28,000 from the state from the one marijuana retailer that existed in Marquette at that time, and in FY2022 we are receiving $225,600 in marijuana tax revenue ($56,400 per retailer). Again, according to Michigan state law, it is illegal for local governments to charge any sales/use tax, including excise taxes on alcohol, tobacco, and marijuana. Marijuana is also an incredibly unstable source of revenue – consider that the amount of tax revenue the City receives from each marijuana retailer nearly doubled from 2021 to 2022 – and as such, the City does not even factor it into our budget planning. This might change at some future date when Michigan’s marijuana market eventually stabilizes, but until then, marijuana is simply too unreliable as a revenue source, and it certainly could never generate enough revenue to significantly reduce the City’s budget deficit.

Q: Haven’t Brownfields and/or the Downtown Development Authority (DDA) TIF District caused all these budget problems? If we didn’t have to deal with TIF, the City would have way more property tax revenue!

A: There have certainly been some Brownfield Plans approved by the City that I felt were unnecessary, and I have voted against multiple Brownfield Plans in my time on the City Commission. It is true that past decisions about Brownfield Plans are part of the City’s current budgetary challenges, and some of these decisions (the DDA TIF District, the Founders Landing & UPHS-Marquette Brownfield Plans, etc.) go back many years or even decades, before most current City Commissioners were elected or even old enough to vote. However, I have heard some residents suggest that the City should just cancel some of its current Brownfield Plans or “reassess” these properties to pay off the Brownfield Plans and get them paying taxes into the General Fund more quickly. This is simply illegal. The City cannot arbitrarily reassess the taxable value of any property, nor can we get rid of the Brownfield Plan which was approved for the new hospital in south Marquette in 2014 or any other Brownfield Plan, as Brownfield Plans are legally binding contracts which require the consent of both parties (the City and the developer) to amend.

It is also important to consider that the City did not just hand out these Brownfield Plans because we were feeling generous. Most of these Brownfield redevelopment projects would not have happened at all if it weren’t for the availability of Brownfield TIF to reimburse the developers for major eligible expenses like environmental assessments and clean-up, vapor mitigation, parking, infrastructure, demolition and site preparation, lead and asbestos abatement, etc. The owners of Brownfield properties still pay taxes – most of those taxes are captured by the Brownfield Redevelopment Authority to reimburse the developer for eligible expenses, and in some cases to reimburse the City for issuing bonds for public infrastructure associated with a Brownfield redevelopment project. In the coming years, these Brownfield Plans will be fully paid off and start paying millions of dollars in property taxes into the City General Fund. For instance, the former Marquette General Hospital redevelopment will produce $1.5-2 million per year for the City starting 10-15 years from now, enough to completely eliminate the City’s current budget deficit all on its own. The new UPHS-Marquette hospital will start paying $1.24 million/year into the General Fund as soon as the late 2020s, and in the 2030s the City General Fund will start receiving taxes from the UP State Bank ($55,000/year), Founders Landing ($314,000/year), and Liberty Way ($169,000/year) – that brings the total future tax revenue from Brownfield projects by the 2040s to $3-4 million each year, a 15-20% increase in revenue for the City General Fund. All of these projects would have been impossible without a Brownfield Plan to make them financially viable for developers. In the long run, this revenue will be the solution to the City’s financial challenges, but it is impossible for the City to unilaterally cancel Brownfield Plans that have already been agreed upon.

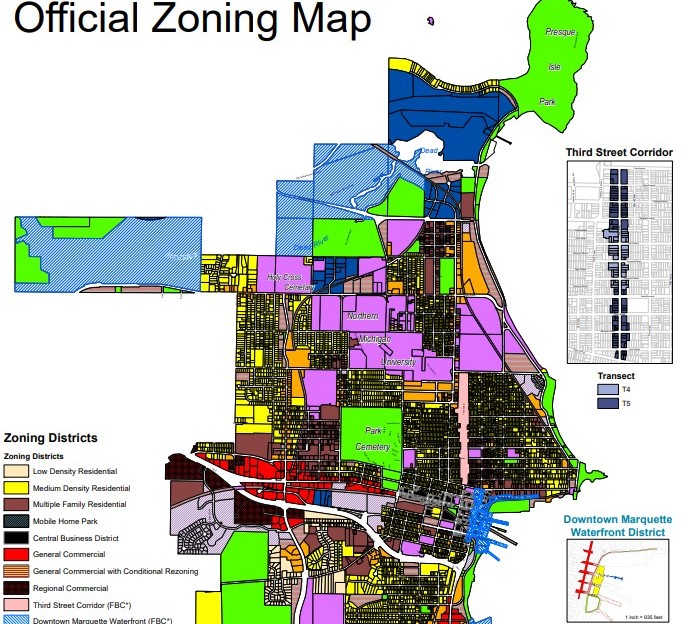

Similarly, we cannot just cancel or revise our current TIF agreement with the DDA at any time – these agreements can only be renegotiated when they are up for renewal or when both parties (the City and the DDA) agree, and the DDA is facing budgetary challenges as well. I am certainly very skeptical of recent DDA proposals to expand their TIF district onto Third Street, but the DDA does provide important services to the downtown district (sidewalk plowing and de-icing, parking maintenance, promotions and events, etc.), and the City would have to pay for most of those services anyway in the DDA’s absence. In short, “defunding the DDA” is also not a realistic or desirable solution to the City’s budgetary problems.

Q: The City Commission has been talking a lot about affordable housing lately, but won’t raising taxes make housing much more expensive for both homeowners and renters?

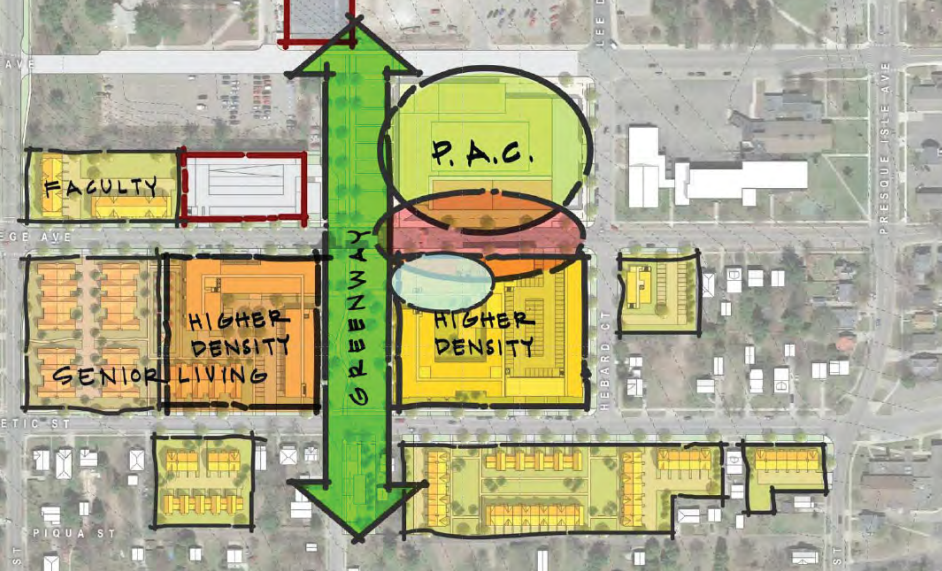

A: I share these concerns about housing costs – I am the only renter on the City Commission, and I worry about the impact of a millage increase on people like me and many of my friends, family, and neighbors who are also renters or homeowners on limited incomes. I also believe that we need more affordable and mid-range housing in Marquette. That is why I chaired the Ad Hoc Housing Committee in 2020-21 and why I recently voted to designate a City-owned property at 600 W Spring St. for low-income/workforce housing development, for zoning reforms that will allow more “Missing Middle Housing” to gradually develop in our community, and for the redevelopment of the former hospital property which will lead to the creation of 300 new housing units (including dozens of senior housing and affordable/workforce housing units) over the next few years, and eventually generate $1.5-2 million in new tax revenue for the City. I believe that the City needs to implement further pro-housing zoning reforms (such as legalizing duplexes City-wide) and set aside as much surplus City-owned land as possible for affordable housing. My hope is that this can dramatically increase the supply of low- and middle-income housing in Marquette over the next few years – I believe the future of our community depends on it.

Regardless, the average renter in the City should only see about an $18-20 increase in their rent per month if their landlord passes down 100% of the cost of a millage increase to their tenants. My rent just went up $25/month and I am on a tight budget, too, so I understand that this is not easy for Marquette residents who are on limited incomes. But would it be preferable to degrade vital City services, see our parks and community spaces close down or fall into disrepair, let our roads and sewers crumble, or lose many of the City’s firefighters, police officers, and the people who maintain our parks, roads, sewers, and water system? Personally, I don’t think it would be, and I don’t think most Marquette renters (or City residents in general) think it would be, either.

That being said, it is important for renters to ask their landlords to justify any significant rent increases to them – I received a letter from my landlords explaining my recent rent increase, and good landlords will be willing to do the same. Some landlords may use a City property tax increase as an excuse to justify a large, sudden rent hike, but remember that the average renter should only see about an $18-20/month increase – of course, this amount will vary quite a bit depending on the size of your apartment and the taxable value of your rental property, but renters would be wise to be skeptical of a sudden large increase being explained away as resulting primarily from increased property taxes.

The impact on homeowners would be similar to that on renters – the average homeowner would see a property tax increase of $226 per year, or $18-20 per month. There would of course be a lot of variation, but the vast majority of Marquette homeowners own a house that falls close to the average home value. Any homeowner, regardless of income, can contact the City and make a payment plan if they are struggling to pay their property taxes. City staff are ready and willing to work with you – what is most important is that you communicate proactively with the City and pay what you can afford, even if it’s not the full amount owed to the City. Many City residents are also eligible for rental assistance, Homestead Property Tax Credits, and/or for disabled veteran or poverty property tax exemptions, and do not even know it. There is help available if you need it.

Q: If approved, when would an operating millage increase affect my tax bill?

A: The increase would take effect July 1, 2022 and would be incorporated into your summer tax bill – winter tax bills will not be affected by an operating millage increase. You do NOT need to pay your summer taxes right away – the deadline for 2022 summer taxes is Sep. 14, 2022, and you can submit summer tax payments with only a small late penalty (1% per month) through Feb. 28, 2023. As a result, all other things being equal, the average homeowner in Marquette could expect to see their summer taxes go up $226 and see their winter taxes remain essentially the same. Again, if you need help paying your taxes, please contact the City of Marquette – we can work with you to set up a payment plan that works for your budget.

Q: What if I pay my taxes using an escrow account?

A: Sometimes mortgage holders overcorrect with escrow withholdings. If the City Commission approves an operating millage increase, you should contact your mortgage company to make sure that the escrow is adjusted to the correct amount.

Final Thoughts

I have serious concerns about an operating millage increase, but the more I study this issue the more it seems that it may be the only realistic option, at least for the near future. If the City has to raise the operating millage rate, I believe we should commit to bringing property taxes back down in a few years once we can get a different, long-term source of new revenue and/or start seeing new tax revenue from the various Brownfield developments around town, which will start hitting the tax rolls in the late 2020s and 2030s.

I hope I was able to address some of the question and concerns that you may have about the proposed City operating millage increase that the City Commission is voting on tomorrow evening – I know it’s not what anyone wants to hear, but I’m just trying to be honest with the people who elected me to do this difficult job. The can has been kicked down the road for many years by past City leaders, and it has landed in the current City Commission’s lap. It is our responsibility to listen to our constituents, and then do what is necessary to put the City back on a fiscally sustainable path. If there are specific City services that you would rather see cut instead of seeing a property tax increase, please let me know – I want to hear from you and I am willing to listen to any and all ideas.